Understanding the nuances between different funding instruments is critical for investors and entrepreneurs in the competitive startup funding environment. In the early stages of investing, convertible bonds and SAFE (simple equity agreement for future shares) are often used. Each offers startups a path to efficiently securing capital, but they have different conditions and implications that can significantly impact the outcome of an investment. In this article, we’ll unpack the debate over secure and convertible notes, exploring their fundamental differences and unique features so you can make an informed choice for your fundraising needs. Let’s dive in!

What are safe notes and convertible notes?

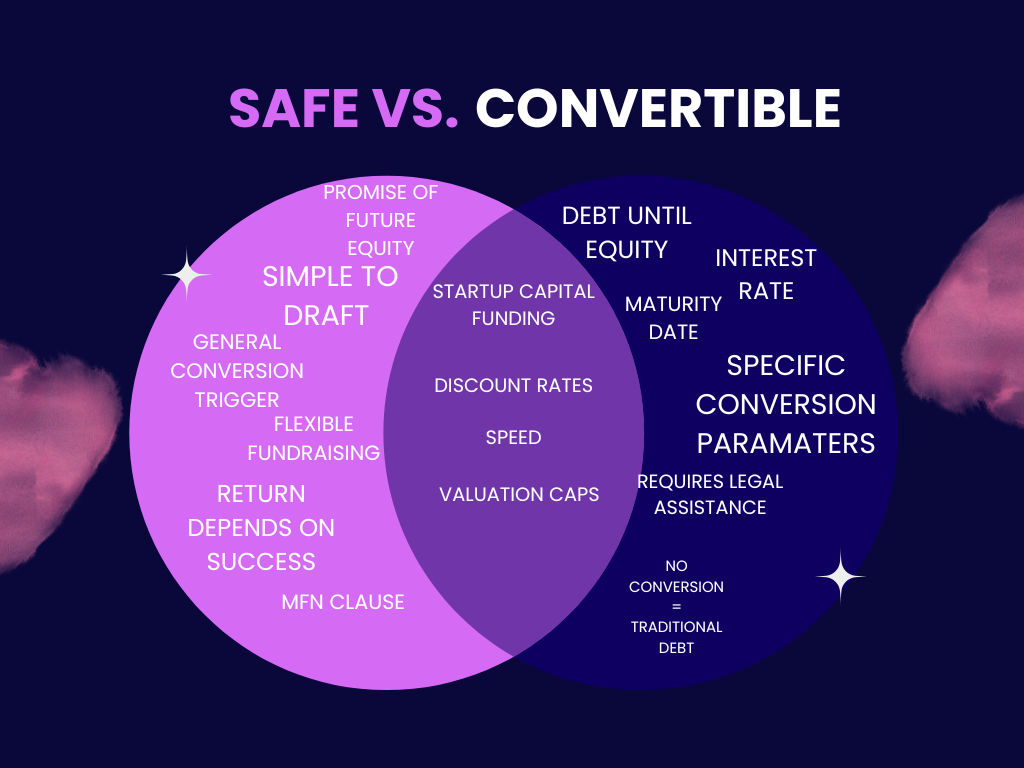

Convertible notes and SAFEs are the two most popular convertible securities in startup financing. Convertible bonds and SAFEs, often called “bridge rounds,” allow entrepreneurs to raise funds from investors in a less complex way than traditional capital raising.

Convertible Note

A convertible bond is a short-term debt instrument that is converted into equity. Essentially, it is a loan made to a company with the understanding that it will be converted into equity in a future round of financing, usually at a discount or a capped valuation. Convertible bonds are designed to defer valuation discussions, allowing startups to raise capital without having to determine their value immediately.

Key Features:

Debt Instrument: Convertible notes are initially structured as debt.

Interest Rates: They usually carry an interest rate, accumulating until conversion.

Maturity Date: They have a set maturity date by which the note must convert to equity or be repaid.

Conversion Terms: Conversion into equity typically happens at a discount to the next round’s valuation or a valuation cap.

Advantages

Deferred Valuation: Startups can postpone valuation negotiations until they have more traction.

Investor Incentives: Discounts and valuation caps can attract investors by offering potential upside.

Simplicity and Speed: Convertible notes can be quicker and less complex to negotiate than priced equity rounds.

Disadvantages

Debt on Balance Sheet: As a debt instrument, it adds liabilities to the company’s balance sheet.

Potential for Default: The company might face repayment obligations if the note doesn’t convert.

Complex Terms: Interest rates and maturity dates add layers of complexity.

SAFE Note

SAFE (Simple Agreement for Future Equity) notes, introduced by Y Combinator in 2013, are agreements that provide rights to investors for future equity. Unlike convertible notes, SAFEs are not debt and do not accrue interest or have a maturity date. They convert into equity during a future priced round, usually at a discount or capped valuation.

Key Features

Non-Debt Instrument: SAFEs are not considered debt, eliminating repayment obligations.

No Maturity Date: There’s no requirement for conversion within a specified timeframe.

Conversion Terms: Like convertible notes, SAFEs convert at a discount or valuation cap in a future financing round.

Advantages

Simplicity: SAFEs are generally more straightforward and quicker to execute than convertible notes.

No Debt: They don’t add liabilities to the balance sheet, reducing financial risk.

Flexibility: The absence of a maturity date allows more flexibility in the conversion timeline.

Disadvantages

Investor Uncertainty: A maturity date can be necessary for investors regarding when they will receive equity.

Dilution Risk: Founders may face significant dilution if not carefully managed.

Less Familiarity: Some investors may need to become more familiar with SAFEs, potentially complicating negotiations.

Comparison: SAFE Note vs. Convertible Note

Key Differences

Nature of Instrument: Convertible notes are debt; SAFEs are not.

Interest and Maturity: Convertible notes accrue interest and have a maturity date; SAFEs do not.

Investor Appeal: Convertible notes may be more attractive to traditional investors because they include interest and maturity dates, providing a clearer timeline for conversion.

Use Cases

Convertible Notes: Suitable for startups that anticipate rapid subsequent funding rounds and want to offer investors additional incentives (interest and maturity).

SAFE Notes are ideal for startups seeking a more straightforward, flexible approach without debt and interest burden.

Strategic Considerations

When choosing between a SAFE and a convertible note, startups should consider:

Investor Preferences: Understand the preferences and familiarity of potential investors.

Company Trajectory: Assess the anticipated timeline for subsequent funding rounds.

Risk Tolerance: Evaluate the financial implications and risks associated with debt instruments versus non-debt instruments.

Market Trends and Future Outlook

According to recent market data, convertible bonds are losing ground to simple future equity (SAFE) agreements in the early-stage finance sector. Y Combinator pioneered SAFEs, which have gained popularity due to their efficiency and simplicity in the ever-changing startup funding environment. This makes it easier for startup founders to negotiate with venture capital firms as they provide them with an instrument without a fixed interest rate or maturity date.

Conversely, convertible bonds are designed as debt instruments that convert into equity at a particular valuation after cash circulation or during events such as a Series A round. Despite their longevity in the sector, their use has declined as SAFEs offer promising results due to their lower complexity and economic efficiency. They allow small businesses to obtain seed funding without worrying about accruing interest or paying off debt, which can be critical to maintaining early revenue growth.

As the startup ecosystem evolves, especially in regions like Silicon Valley, the path to an initial public offering (IPO) includes an increasingly diverse range of financing mechanisms. A preference for SAFE may influence how venture capital firms approach early-stage investments and may ease the transition to later funding rounds.

To summarize, founders’ preference for SAFE envisions a future in which startups choose simplicity and flexibility in their early funding rounds. This bias could change expectations for financial instruments in the lead-up to a Series A round or IPO, affecting both founders and investors in the long term.

Wrapping Up

Most people in business circles these days believe that SAFE notes are better. They are more straightforward and lighter and do not have the same cumbersome regulations as convertible notes. What’s also amazing is that Y Combinator provides links to these four documents. This significantly reduces legal costs, a welcome relief for investors and entrepreneurs.

Ultimately, the most important thing is that investors and founders are satisfied with the outcome, no matter what type of stock conversion contract you decide to use. In light of this, ensure that any SAFE bonds you offer will not significantly reduce founders’ equity in the future. Watching as your ownership dropped from 75%, for example, to 35% would be very challenging.

If you’re unfamiliar with SAFE notes, talk to others to ensure you understand cap table math well enough to organize your notes effectively. Otherwise, SAFE notes’ ease of use and flexibility outweigh their disadvantages. Therefore, SAFE notes are the best approach for most startups!

Related articles

Convertible Note vs SAFE Note

Understanding the nuances between different funding instruments is critical for investors and entrepreneurs in the competitive startup funding environment. In […]